Table Of Contents

Hey there! Imagine you are watching the news, and tensions between India and Pakistan are heating up.

It is scary to think about war, especially between two countries with a significant global impact.

However, many wonder: What would happen to gold prices if a war broke out?

Gold is like that reliable friend people turn to when things get shaky, and history shows it often gets pricier during tough times.

Let’s examine why that happens, what is happening now, and what could happen to gold if things worsen.

Do not worry, we will keep it simple!

Quick Takeaways

- Gold Loves Chaos: When wars or big problems happen, people buy gold to feel safe, which pushes prices up.

- India and Pakistan Matter: These countries love gold, so a war there could increase prices.

- History Backs It Up: Past wars, like the Gulf War, saw gold prices climb 10-15%.

- It is Not Certain: Prices would likely rise, but how much depends on how bad things get.

Why Gold Is A Big Deal When Trouble Hits

Gold is like a superhero for investors when the world feels unsteady.

When stocks or money in the bank seem risky, people buy gold because it holds its value.

Think of it as a cosy blanket during a storm.

For example, when the economy crashed in 2008, gold prices shot up from $730 to $1,300 in just two years!

More recently, when Russia and Ukraine started fighting in 2022, gold prices jumped 8% because people were nervous (Forbes – Gold Price History).

Why does this happen? Gold is seen as a “safe-haven” asset.

It is not tied to one country’s economy and has been valuable for centuries.

When things like wars or big political fights happen, people want something they can trust, and gold fits the bill.

What Is Going On With India And Pakistan?

India and Pakistan have had a rocky relationship for years, primarily because of a region called Kashmir.

Things got extra tense in April 2025 after a terrible attack in Pahalgam, where 26 people lost their lives.

This led to some big moves: India paused a water-sharing deal, and Pakistan stopped Indian planes from flying over its land.

These actions have increased gold prices in India as people started buying more to feel secure (NPR – India-Pakistan Tensions).

Both countries are huge fans of gold.

India is one of the world’s biggest gold buyers, especially for jewellery during weddings and festivals.

Pakistan also loves gold for similar reasons.

If a war started, people in these countries would likely buy even more gold, increasing prices worldwide.

What History Shows Us

Let us look at what has happened before to get a clue.

During the Gulf War in 1990-1991, gold prices increased by about 12% because people worried about oil and global stability.

When Russia invaded Ukraine in 2022, gold got 8% pricier as the world freaked out about sanctions and trade problems.

Even more minor conflicts, like the Israel-Hamas tensions in 2023, bumped gold prices by 5%.

An India-Pakistan war could be a bigger deal because both countries have nuclear weapons, which makes the world super nervous.

Plus, they are big players in the gold market.

So, if fighting started, gold prices could climb significantly—maybe even more than in those past examples.

What Experts Are Saying

People studying markets think gold prices would likely increase if India and Pakistan went to war.

One report said gold, already popular when things are uncertain, could “rally further” if tensions worsen (Asia Times – India-Pakistan War Fallout).

Other experts, like those at Advantage Gold, point out that global conflicts in 2025 will keep gold in high demand (Advantage Gold—Geopolitical Issues).

Like those in Asia, big banks buy more gold to stabilise their economies during troubled times.

This extra buying helps keep gold prices high (World Gold Council – Asset Allocation).

Why Would Gold Prices Jump?

Let us break it down:

- More Buyers in India and Pakistan: People in these countries would rush to buy gold for safety and tradition, driving demand.

- Global Worry: A war with nuclear risks would make investors worldwide nervous, so that they would buy gold too.

- Trade Troubles: Gold becomes a go-to for protecting wealth if war messes up trade or money values.

- Bank Moves: Big banks might stock up on gold, which keeps prices climbing.

For example, if trade routes are blocked or countries impose sanctions, money might lose value, and gold might become even more attractive. It is like choosing a sturdy boat when the sea gets rough.

How Much Could Prices Change?

It is hard to say exactly, but history gives us hints. In past wars, gold prices went up 10-15%.

With India and Pakistan, it could be similar or even bigger because of their gold obsession and the nuclear factor.

If the war stayed small, the price bump might be less.

However, if things got bad, gold could skyrocket as everyone scrambled to buy it (World Gold Council—Geopolitics and Gold).

Here is a quick look at past price jumps:

| Event | Year | Jump | Fear |

|---|---|---|---|

| Gulf War | 1990-91 | 12% | Worry about oil and stability |

| Russia-Ukraine War | 2022 | 8% | Sanctions and global panic |

| Israel-Hamas Conflict | 2023 | 5% | Regional tension |

| India-Pakistan Tensions (2025) | 2025 | Still rising | Fear of a bigger conflict |

What Could Change Things?

A few things could affect how much gold prices move:

- How Big the War Is: A minor skirmish might not shake markets much, but a full-blown war would.

- Global Reaction: Gold demand could spike if other countries get involved or markets panic.

- Other Safe Options: Some might choose other safe assets, like the Swiss franc, which could slow gold’s rise.

Still, gold’s track record makes it a top choice when things get dicey.

Wrapping It Up

So, would gold prices increase if India and Pakistan went to war?

All signs point to yes.

People in both countries would buy more gold, and the world would get nervous, increasing prices.

History shows us this happens during wars, and experts agree 2025 could see gold shine bright if tensions boil over.

How much prices rise depends on how serious things get, but a 10-15% jump is not out of the question.

Watch the news if you are thinking about gold or just curious about markets.

Want to learn more about investing or how the world affects your money?

Check out our other articles for easy-to-read tips and insights. We are here to help you make sense of it all!

Fun Fact

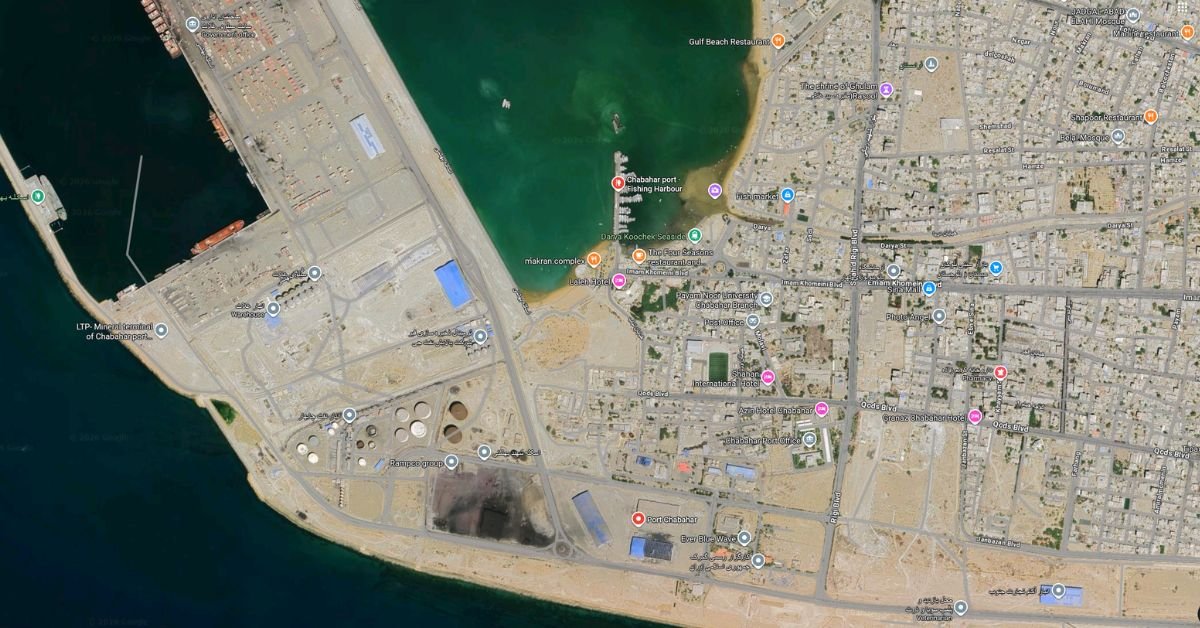

Did you know India’s love for gold is so significant that it imports about 800 tons yearly, enough to fill 40 shipping containers? That is a lot of sparkle!

Note: This is just information to help you understand. Talk to a financial advisor before making any financial decisions.