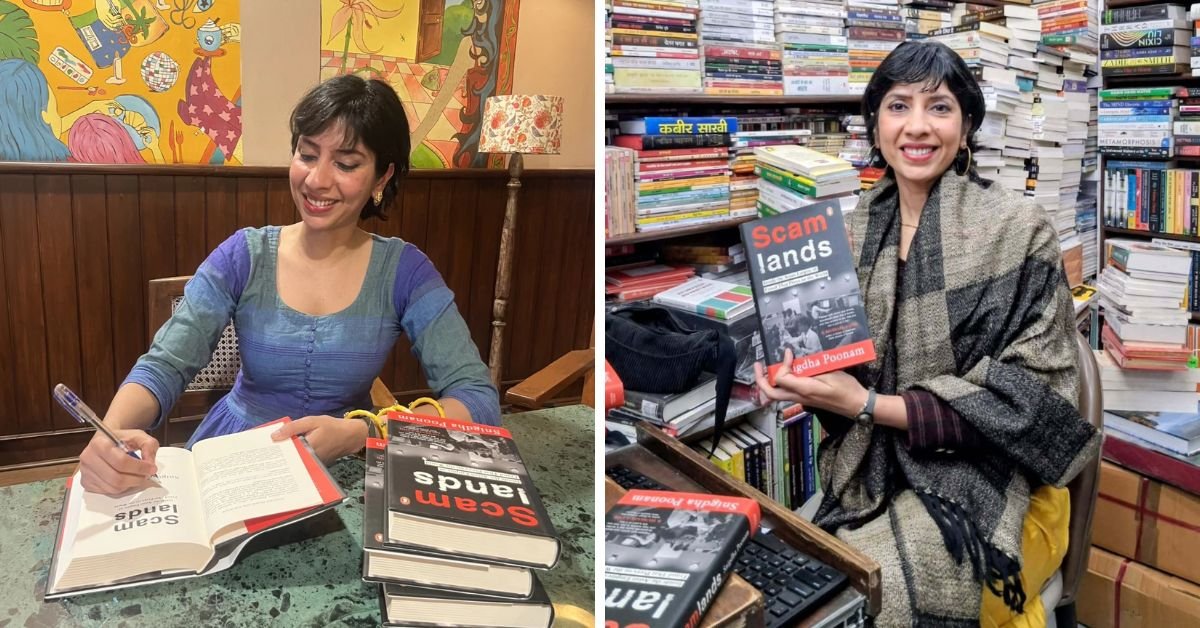

Uncover Mehul Choksi’s life, PNB scam role, wife, net worth, and current Belgium custody. Dive into his arrest, crimes, and the mystery woman saga.

Table Of Contents

Mehul Choksi

Mehul Choksi‘s name echoes through India’s financial corridors as a symbol of audacious fraud and international intrigue.

Once a titan of the jewelry industry, Choksi is now a fugitive entangled in one of India’s largest banking scandals, the Punjab National Bank (PNB) scam.

Who is this enigmatic figure?

What crimes catapulted him to infamy?

Where is he hiding today, and who are the key players in his life, from his wife to the mysterious woman linked to his alleged kidnapping?

This comprehensive blog post will unravel Choksi’s biography, dissect his crimes, explore his net worth, and bring you the latest updates as of June 2025.

With fresh insights and a human touch, let us dive into a story that’s equal parts thriller and cautionary tale!

Who Is Mehul Choksi?

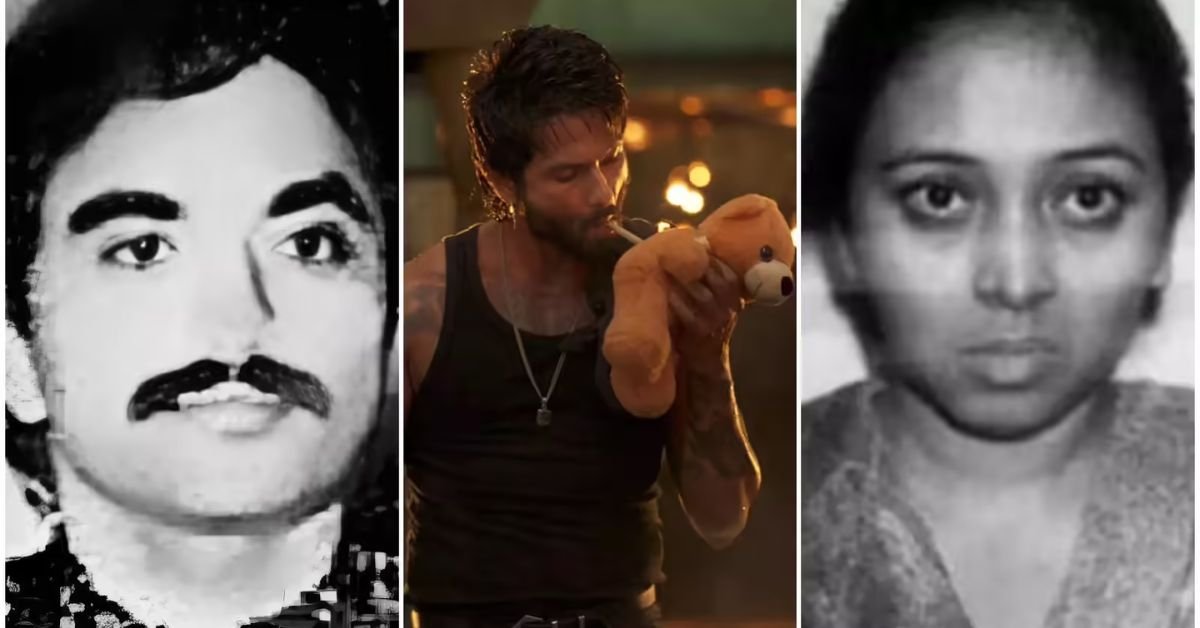

Mehul Chinubhai Choksi, born May 5, 1959, in Mumbai, India, was once the poster child of entrepreneurial success.

As the chairman and managing director of the Gitanjali Group, he transformed a family jewelry business into a global empire.

Today, his name is synonymous with the PNB scam, a ₹14,000 crore fraud that shook India’s banking sector.

His journey from a celebrated businessman to a wanted fugitive is a saga of ambition, betrayal, and relentless pursuit.

Early Life And Rise To Fame

Growing up in Mumbai, Choksi was immersed in the diamond trade from a young age.

His uncle, Chinubhai Choksi, founded Gitanjali Gems, and Mehul joined the family business in the 1980s.

With a keen eye for branding, he expanded Gitanjali into a retail juggernaut, boasting over 4,000 stores across India and internationally.

Brands like Nakshatra, Gili, and Asmi became household names, endorsed by Bollywood stars like Aishwarya Rai and Katrina Kaif.

By 2010, Gitanjali Gems was listed on the Bombay Stock Exchange with a valuation exceeding ₹8,000 crore.

Choksi’s charisma and networking skills made him a darling of India’s elite.

He sponsored high-profile events, including fashion shows and film awards, cementing his status as a luminary in the luxury goods sector.

His Mumbai office, adorned with sparkling displays, was a testament to his success until it symbolized his downfall.

Personal Life And Family

Choksi is married to Preeti Choksi, a Belgian citizen who has stood by him through his turbulent years as a fugitive.

The couple has two daughters, whose identities are closely guarded to shield them from public scrutiny.

While Choksi’s professional life was flamboyant, his family maintained a low profile, though recent events have drawn attention to his wife and alleged connections.

| Aspect | Details |

|---|---|

| Full Name | Mehul Chinubhai Choksi |

| Date of Birth | May 5, 1959 |

| Hometown | Mumbai, India |

| Education | Educated in Mumbai; no formal degree details publicized |

| Business | Chairman and MD, Gitanjali Group |

| Family | Wife: Preeti Choksi; two daughters (names private) |

What Did Mehul Choksi Do?

The Punjab National Bank scam, uncovered in 2018, is the cornerstone of Choksi’s infamy.

Alongside his nephew, Nirav Modi, Choksi is accused of defrauding PNB of ₹13,850 crore (approximately $1.8 billion) through fraudulent Letters of Undertaking (LoUs) and Foreign Letters of Credit (FLCs).

The scam exposed glaring loopholes in India’s banking system and triggered a nationwide search.

Mechanics Of The Fraud

From 2014 to 2017, Choksi’s Gitanjali Group and Nirav Modi’s companies allegedly colluded with corrupt PNB officials at the bank’s Brady House branch in Mumbai.

They secured fake LoUs, which allowed their firms to borrow funds from foreign banks without collateral.

These funds were funneled through shell companies, often in Hong Kong and Dubai, and used for personal enrichment or to roll over earlier loans.

The scam went undetected for years due to lax oversight and manual record-keeping.

When PNB discovered the fraud in January 2018, it filed a complaint with the Central Bureau of Investigation (CBI).

The agency revealed that Choksi’s firms were linked to ₹6,097 crore of the fraud, while Modi’s companies accounted for ₹6,498 crore.

Choksi fled India on January 2, 2018, just weeks before the scam surfaced, citing health issues.

Additional Financial Misconduct

Beyond PNB, Choksi faced allegations of insider trading with Gitanjali Gems, leading to a ₹2.1 crore fine from the Securities and Exchange Board of India (SEBI).

In June 2025, SEBI froze his accounts to recover these dues.

He also defaulted on a loan from ICICI Bank, prompting further legal action.

The Enforcement Directorate (ED) uncovered a money laundering network, with Choksi allegedly using 15 shell companies to divert funds.

Legal Charges

Choksi faces charges under multiple sections of the Indian Penal Code (IPC), including criminal conspiracy, cheating, and corruption, as well as the Prevention of Money Laundering Act (PMLA).

Interpol issued a Red Notice against him in 2018, making him a global fugitive.

| Scam | Information |

|---|---|

| Total Fraud Amount | ₹13,850 crore (~$1.8 billion) |

| Choksi’s Share | ₹6,097 crore |

| Key Method | Fake LoUs and FLCs to secure overseas credit |

| Agencies Involved | CBI, ED, SEBI, Interpol |

| Other Violations | Insider trading, ICICI loan default, money laundering |

Where Is Mehul Choksi Now?

As of June 29, 2025, Mehul Choksi is in custody in Belgium, battling extradition to India.

His journey from Mumbai to Belgium is a labyrinth of evasion, arrests, and legal maneuvers, making him one of India’s most elusive fugitives.

Escape From India

Choksi fled India on January 2, 2018, days before the PNB scam broke.

He resurfaced in Antigua and Barbuda, where he had secured citizenship in 2017 through the Citizenship by Investment Program.

For three years, he lived a quiet life in Antigua, running a jewelry store and avoiding extradition efforts.

However, in May 2021, his saga took a dramatic turn.

The Antigua-Dominica Episode

On May 23, 2021, Choksi vanished from Antigua, only to be found in Dominica two days later.

He claimed he was kidnapped from Jolly Harbour, Antigua, by a woman named Barbara Jarabik, who lured him to an apartment.

There, he alleged, a group of men tasered him, bundled him onto a yacht, and smuggled him to Dominica as part of an Indian plot to expedite his extradition.

Dominica charged him with illegal entry, but he was granted bail in July 2021 and returned to Antigua.

Relocation To Belgium

By 2023, Choksi had moved to Antwerp, Belgium, reportedly living in a rented flat with his wife, Preeti.

Some reports suggest he obtained a Belgian residency card through questionable means, though this remains unconfirmed.

On April 11, 2025, Antwerp police arrested him near his residence, acting on an extradition request from India.

He was detained in a hospital, citing heart and respiratory issues, and has remained in custody since.

Extradition Battle

An Antwerp court reviewed Choksi’s extradition plea on June 14, 2025, but denied relief, scheduling the next hearing for September 2025.

The CBI has bolstered its case with evidence of Choksi’s fraudulent activities, invoking the 1901 India-Belgium extradition treaty and UN conventions.

Choksi’s legal team, led by Vijay Aggarwal, argues that the case is politically motivated and lacks sufficient grounds.

His health claims, including a “freedom request” filed in June 2025, have been rejected, keeping him behind bars.

| Timeline | Details |

|---|---|

| January 2018 | Fled India for Antigua and Barbuda |

| May 2021 | Alleged kidnapping from Antigua to Dominica; freed on bail |

| 2023 | Moved to Antwerp, Belgium, with a residency card |

| April 11, 2025 | Arrested by Antwerp police |

| June 14, 2025 | Extradition hearing; next hearing in September 2025 |

| Current Status | In custody in Belgium |

Who Is Mehul Choksi’s Wife?

Preeti Choksi, Mehul’s wife, is a Belgian citizen who has steadfastly supported him through his legal troubles.

Little is known about her early life, as she has avoided the media spotlight.

Reports indicate she accompanied Choksi to Belgium in 2023, living with him in Antwerp.

Her Belgian citizenship likely facilitated their relocation, though allegations of forged residency documents have surfaced, adding intrigue to her role.

Preeti has not been implicated in the PNB scam or related crimes, but her presence underscores the family’s efforts to navigate Choksi’s fugitive status.

Though she maintains a low profile, she is believed to be managing family affairs while Choksi remains in custody.

| Profile | Details |

|---|---|

| Name | Preeti Choksi |

| Citizenship | Belgian |

| Role | Wife of Mehul Choksi; not implicated in scams |

| Current Location | Believed to be in Belgium, supporting Choksi |

Who Is Mehul Choksi’s Girlfriend?

The “mystery woman” in Choksi’s narrative is Barbara Jarabik, a Hungarian luxury goods expert who met him in Antigua in August 2020.

In May 2021, Choksi alleged that Jarabik lured him to an apartment in Jolly Harbour, Antigua, as part of a honeytrap orchestrated by Indian agents.

He claimed a group of men burst in, tasered him, and smuggled him by yacht to Dominica, where he was detained for illegal entry.

Choksi’s accusations form the basis of a lawsuit filed in 2024 against the Indian government and five individuals: Gurdip Bath, Gurmit Singh, Gurjit Singh Bhandal, Leslie Farrow-Guy, and Jarabik in London’s High Court.

He alleges the kidnapping was a plot by India’s Research and Analysis Wing (R&AW) to force his extradition.

India denies the claims and seeks dismissal of the case on the grounds of state immunity.

Jarabik and the other suspects, mostly UK-based, have also denied involvement, calling Choksi’s allegations baseless.

The incident remains a flashpoint, with Choksi’s legal team using it to argue against extradition, claiming he is a victim of persecution.

The truth behind Jarabik’s role remains unresolved, whether she was a conspirator or an unwitting accomplice.

| Details | Information |

|---|---|

| Name | Barbara Jarabik |

| Nationality | Hungarian |

| Alleged Role | Lured Choksi in Antigua (per his claims); denies involvement |

| Connection | Met Choksi in August 2020; linked to 2021 kidnapping allegations |

Mehul Choksi’s Daughters

Choksi has two daughters, whose names are deliberately kept out of the public domain to protect their privacy.

Unlike their father, they have avoided media attention, and little is known about their education, careers, or current whereabouts.

Given Choksi’s international movements, they may live with family members abroad, possibly in Europe or the Caribbean.

Their low profile reflects the family’s efforts to insulate them from the fallout of the PNB scam and ongoing legal battles.

| Profile | Details |

|---|---|

| Number | Two daughters |

| Names | Not publicly disclosed |

| Current Status | Likely living privately, possibly abroad |

Mehul Choksi’s Net Worth

Before the PNB scam, Mehul Choksi’s net worth was estimated at ₹10,000–12,000 crore, fueled by Gitanjali Group’s success and investments.

He owned luxury properties in Mumbai, Dubai, and New York, a private jet and a yacht, epitomizing the billionaire lifestyle.

However, the scam and subsequent asset seizures have decimated his wealth.

The ED has seized assets worth over ₹2,548 crore, including properties, bank accounts, and jewelry.

SEBI’s June 2025 freeze on Choksi’s accounts for ₹2.1 crore in unpaid fines further strained his finances.

While some speculate he retains access to offshore funds, his ability to sustain a lavish lifestyle is doubtful.

His ongoing legal battles in Belgium and the UK, involving top-tier lawyers, suggest some remaining resources, but their scale is unclear.

| Overview | Details |

|---|---|

| Pre-Scam Estimate | ₹10,000–12,000 crore |

| Current Estimate | Significantly reduced; exact figure unknown |

| Asset Seizures | ₹2,548 crore by ED; ₹2.1 crore frozen by SEBI |

| Financial Status | Funds tied up in legal battles; possible offshore accounts |

Latest News On Mehul Choksi

Choksi’s case has seen significant activity in 2025, keeping him in the headlines.

Here is a detailed look at the latest updates as of June 29, 2025:

- Extradition Proceedings: On June 14, 2025, an Antwerp court reviewed Choksi’s extradition plea but upheld his detention, citing flight risk. The next hearing is set for September 2025. The CBI has submitted extensive evidence, including bank records and witness statements, while Choksi’s team argues the charges are fabricated. The case hinges on Belgium’s interpretation of the 1901 extradition treaty.

- London Lawsuit: Choksi’s 2024 lawsuit against India in London’s High Court alleges a 2021 kidnapping from Antigua. India’s counsel argued for dismissal in a June 2025 hearing, citing state immunity and lack of jurisdiction. Choksi claims he was beaten and coerced into a false confession, naming five individuals as conspirators. The case is ongoing, with potential implications for his extradition.

- SEBI Crackdown: In June 2025, SEBI escalated efforts to recover ₹2.1 crore in fines from Choksi for insider trading violations. His bank, demat, and mutual fund accounts were frozen, limiting his financial maneuverability.

- Health and Bail Attempts: Choksi has repeatedly cited health issues, including heart and respiratory problems, to seek bail. His April 2025 arrest occurred in a hospital, and a June “freedom request” on medical grounds was denied. Authorities view his health claims skeptically, given his history of delaying tactics.

- Family Movements: Reports suggest Choksi’s brother, Chetan Chinubhai Choksi, who ran a diamond firm in Antwerp, may assist with his defense. The family’s presence in Belgium adds complexity to the case.

| Recent | Details |

|---|---|

| Extradition Status | In custody in Belgium; next hearing in September 2025 |

| UK Lawsuit | Suing India for the 2021 kidnapping; India seeks dismissal |

| SEBI Action | Accounts frozen for ₹2.1 crore in unpaid fines |

| Health Claims | Cited for bail; rejected by the court |

| Family Involvement | Brother Chetan is possibly aiding the defense |

Crime That Redefined Banking

The PNB scam was not just a financial heist but a wake-up call for India’s banking sector.

Choksi and Nirav Modi’s ability to exploit LoUs for years exposed systemic weaknesses, from manual processes to inadequate audits.

The scam prompted sweeping reforms, including the Fugitive Economic Offenders Act 2018, designed to target absconders like Choksi.

Broader Implications

- Banking Reforms: PNB overhauled its LoU processes, adopting digital tracking and stricter oversight. The Reserve Bank of India (RBI) phased out LoUs entirely in 2018.

- Economic Impact: The scam eroded investor confidence, with Gitanjali Gems’ stock crashing from ₹800 to under ₹10 in 2019. Thousands of employees lost their jobs as the company collapsed.

- Public Outrage: The case fueled debates about crony capitalism, with Choksi and Modi seen as symbols of unchecked wealth.

Choksi’s Criminal Network

The ED’s probe revealed Choksi used 15 shell companies to launder funds, with transactions routed through Hong Kong, Dubai, and the US.

His firms inflated import values to siphon money, a tactic known as “round-tripping.”

The agency also linked him to five other bank frauds, pushing his total liability to over ₹14,000 crore.

| Scam | Details |

|---|---|

| Bank Losses | ₹13,850 crore; partial recovery of ₹2,548 crore |

| Gitanjali Group | Collapsed; stock value decimated |

| Employees | ~10,000 job losses |

| Regulatory Changes | Fugitive Economic Offenders Act, RBI’s LoU ban |

Dr. Mehul Choksi: Clearing The Confusion

Some online references to “Dr. Mehul Choksi” are erroneous.

Choksi holds no doctoral degree, and the title likely stems from confusion over his business prominence or mistranslations.

His expertise is in jewelry retail and finance, not academia or medicine.

The Loan Amount: Quantifying The Fraud

The PNB scam’s core involved ₹13,850 crore in fraudulent loans, with Choksi’s Gitanjali Group responsible for ₹6,097 crore.

These funds were secured through 1,200 fake LoUs issued over four years.

The ED’s broader investigation uncovered fraud across five other banks, including ICICI and Axis, pushing Choksi’s total liability to ₹14,356 crore.

Recovery efforts have yielded ₹2,548 crore, but the remaining amount poses a challenge for authorities.

| Loan | Details |

|---|---|

| PNB Scam Total | ₹13,850 crore |

| Choksi’s Share | ₹6,097 crore |

| Total Liability | ₹14,356 crore (including other banks) |

| Recovery | ₹2,548 crore seized; ongoing efforts |

Mehul Choksi’s Arrest

Choksi’s arrest in Antwerp on April 11, 2025, was a milestone in India’s pursuit of justice.

Acting on a CBI request, Belgian police detained him near his residence, ending speculation about his whereabouts.

He was hospitalized during the arrest, citing health issues, but was soon transferred to a detention facility.

His lawyer, Vijay Aggarwal, confirmed his incarceration and vowed to challenge the extradition, arguing that India’s case lacks merit.

The arrest has galvanized Indian authorities, who see it as a step toward repatriating Choksi.

However, his legal team’s aggressive defense and health-related delays could prolong the process.

The case has also spotlighted Belgium’s role in international extradition, with diplomatic channels working overtime.

| Arrest | Information |

|---|---|

| Date | April 11, 2025 |

| Location | Antwerp, Belgium |

| Arresting Authority | Antwerp police, on CBI request |

| Current Status | In custody, fighting extradition |

Choksi’s Global Footprint

Choksi’s ability to evade capture for years reflects his extensive international network.

His businesses operated in 15 countries, with offices in New York, London, and Hong Kong.

He leveraged these connections to secure Antigua’s citizenship and Belgium’s residency, raising questions about the ease of obtaining such privileges.

His brother, Chetan, ran a diamond firm in Antwerp, potentially aiding his relocation.

Choksi’s influence also extended to Interpol, where he allegedly lobbied to lift the Red Notice against him in 2022, though it was reinstated in 2023.

His legal battles span three continents, showcasing his ability to navigate complex jurisdictions.

| Network | Details |

|---|---|

| Business Reach | 15 countries; key hubs in New York, London, Hong Kong |

| Citizenship | Antigua and Barbuda (2017); Belgian residency (2023) |

| Family Connections | Brother Chetan in Antwerp; wife Preeti’s Belgian citizenship |

| Interpol | Red Notice issued in 2018, briefly lifted in 2022, reinstated in 2023 |

Human Cost: Victims Of The Scam

The fallout of the PNB scam extended beyond banks and investors.

Small businesses that supplied Gitanjali Gems faced bankruptcy when payments stopped.

Employees, many with decades of service, were left jobless without severance.

Customers who bought Gitanjali jewelry felt betrayed as the brand’s reputation crumbled.

The scam also strained India-Belgium relations, with Choksi’s extradition becoming a diplomatic flashpoint.

| Victims | Impact |

|---|---|

| Suppliers | Unpaid dues led to bankruptcies |

| Employees | ~10,000 job losses; no severance |

| Customers | Loss of trust in Gitanjali brands |

| Diplomatic Ties | Tensions over extradition delays |

Choksi’s Legacy

Mehul Choksi’s story is a stark reminder of the perils of unchecked ambition.

His rise showcased India’s entrepreneurial potential, but his fall exposed the fragility of its financial systems.

The PNB scam spurred reforms, but the scars remain: job losses, eroded trust, and a lingering sense of injustice.

As Choksi fights extradition in Belgium, his case underscores the challenges of pursuing economic offenders across borders.

The September 2025 hearing will be pivotal.

Will Choksi return to India to face trial, or will he prolong his legal odyssey?

His saga is a testament to the complexities of global justice, where wealth, influence, and determination collide.

Conclusion

Mehul Choksi’s journey from a jewelry magnate to a fugitive in a Belgian cell is a gripping tale of greed, deception, and resilience.

With court battles in Belgium and London, a mysterious kidnapping claim, and a family navigating the storm, his story keeps us on the edge of our seats.

At THOUSIF Inc. – INDIA, we are passionate about unpacking such narratives with clarity and heart.

Loved this deep dive.

Check out our blog for more stories about finance, crime, and global affairs.

Share your thoughts below: Will Choksi face justice or slip through the cracks again?

Trivia Time!

Did You Know? Mehul Choksi’s Gitanjali Group once gifted diamond jewelry to Bollywood stars at award shows, with pieces valued at lakhs. Many celebrities distanced themselves post-scam, but the brand’s glitzy past remains a Bollywood footnote!